What is ACMI Leasing

Also known as wet or damp leasing, ACMI leasing is an agreement between two airlines, where the lessor agrees to provide an aircraft, crew, maintenance and insurance (ACMI) to the lessee – in return for payment on the number of block hours operated.

ACMI provides the lessee with additional or replacement capacity, even at short notice.

When to use ACMI Leasing

We provide expert advice and actively manage our clients’ aviation assets, offering a range of services with the primary goal of maximising value and minimising risk across aviation portfolios.

Urgent Cover

Aircraft and crew can be wet leased in on a short-term basis. A fully-crewed aircraft is provided, minimising service disruption in the event of sudden unforeseen issues (such as an aircraft suffering a technical fault or a lack of available crew).

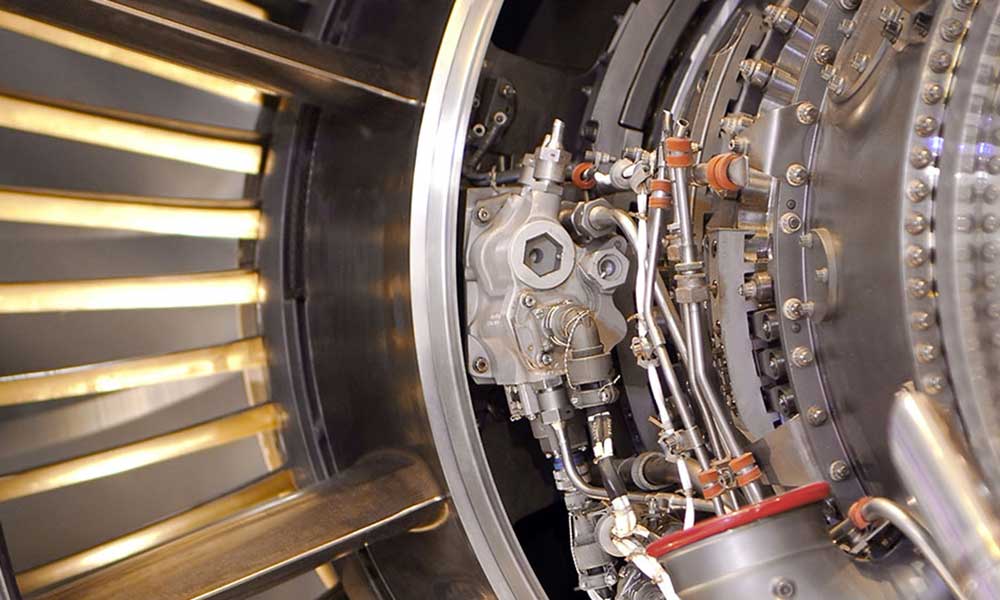

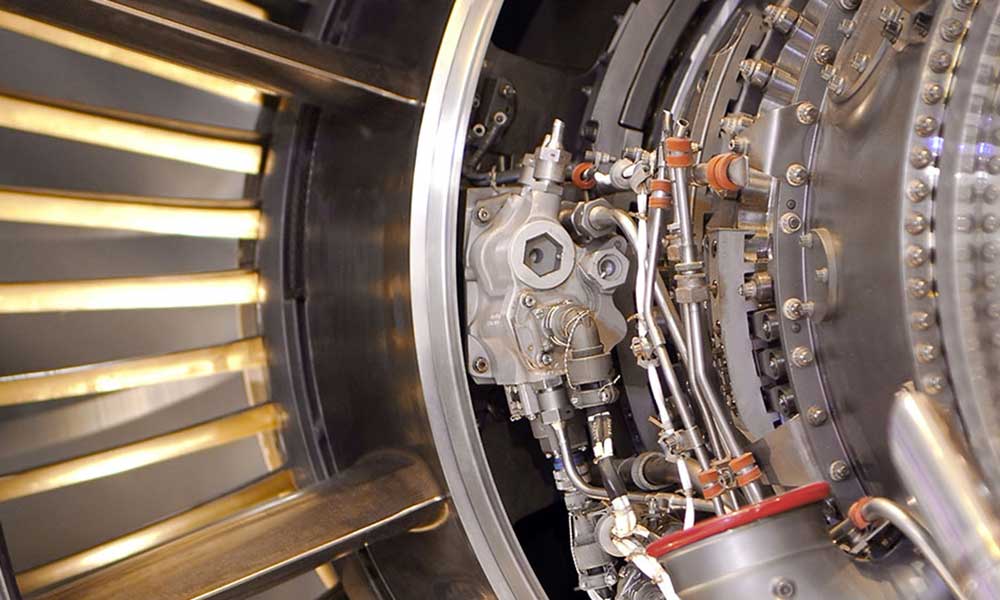

Planned maintenance and late deliveries

Even when planned, maintenance can take an aircraft out of commission for anywhere between two weeks and three months – potentially leading to service cancellations. Longer-term leasing solutions ensure that scheduled flights continue to operate for the duration of planned maintenance periods.

Aircraft manufacturers are currently operating significant outstanding order backlogs, leading to aircraft delivery delays. Airlines can avoid scheduling issues brought about by delayed deliveries with leasing.

Seasonal demand and new routes

When planning ahead for seasonal peaks or testing new markets and routes, operators need to be able to lease in additional capacity for as long as necessary. ACMI provides additional or replacement aircraft quickly – allowing operators to continue a seamless service without compromising their schedule.

Urgent Cover

Planned maintenance and late deliveries

Seasonal demand and new routes

The advantages of acmi to the aircraft lessee

The main advantage of wet leasing is flexibility. Subject to availability, lease operations can be started quickly – filling immediate capacity requirements.

Alternatively, a wet lease can be used over longer periods – providing supplemental seasonal availability. Wet leasing is ideal for testing new routes and markets, without having to invest heavily in new aircraft and crew first.

An operating or finance lease, also known as a dry lease, typically requires a minimum-term commitment. Purchasing an aircraft represents a significant capital investment that simply isn’t practical for some operators.

Wet leasing is completely flexible – use it when you need it. ACMI allows lessees to supplement their fleet capacity – without committing to an investment that may never produce a return.

The advantages of acmi to the aircraft lessor

ACMI allows the lessor to achieve greater fleet efficiency with lower risk. By leasing surplus capacity during low operating seasons, lessors can continue to earn without the associated commercial exposure of selling tickets. The income generated from ACMI provides a consistent revenue stream, as opposed to ticket sales’ variable revenue – and generally avoids compensation liability under EU Regulation 261/2004.

By taking advantage of counter-seasonal demand in other international markets, fleet capacity is used year-round – spreading the operating costs across a greater number of flight hours and reducing flight hour rates.

Damp Leasing

A damp lease is similar to a wet lease – but the lessee has sufficient cabin crew to operate the leased flights. Damp leasing is tailored to an airline’s specific operational requirements to maximise efficiency, by removing the costs of all (or part) of the cabin crew and HOTAC.

LET ACC TAKE CARE OF YOUR WET LEASING

We work with operators around the world, contracting tens of thousands of block hours annually on their behalf.

We are able to source and deploy aircraft anywhere, 24/7/365, from a global network of suppliers – and our team has the experience to find the most viable solution for each situation. ACC will always seek to negotiate the most competitive rates, for immediate short-term capacity or for a longer-term lease.