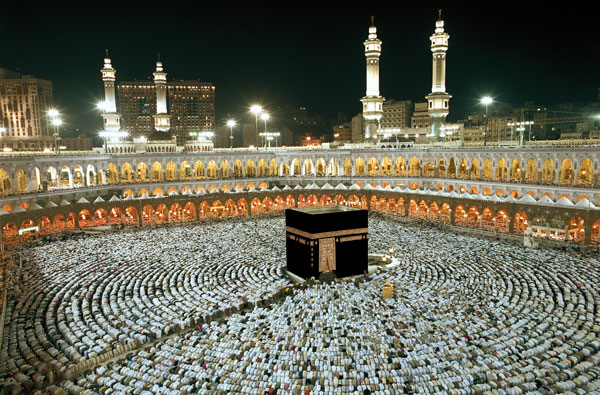

With the Hajj and Umrah tourism market set to continue its exponential growth over the next few years, we look at the unique aspects of the aircraft leasing market in the Middle East and the role of ACMI leasing.

The Lunar Calendar and Hajj Travel

The Hajj is one of the most important dates in the Islamic calendar; a lunar calendar that works differently to the Gregorian calendar that most Europeans and North Americans are familiar with. So, unlike New Year’s Eve, which falls on the 31st of December every year, Hajj dates move backwards through the Gregorian calendar (as lunar months are shorter than Gregorian calendar months). And for the next ten years, the Hajj will take place during the northern hemisphere’s summer months.

The date of the pilgrimage will descend from September, backwards into June with each passing year – landing it right in the middle of Europe’s peak air travel period. This will pose some challenges for European air operators and lessors, who would normally shift capacity to Middle Eastern peak times during troughs in the local market. For the next decade, the huge demand for Hajj travel will be competing with a European market at capacity (this shift repeats every 33 lunar years).

There are also restrictions imposed by the Saudi Arabian Civil Aviation Authority (CAA), prohibiting the use of aircraft older than 20 years of age, whereas previously aircraft 25 years or less were permitted, further limiting the pool of aircraft available for lease.

Additionally, Hajj customers regularly require aircraft with high density seat configurations, which are in scarce supply, making the sourcing of suitable Hajj capacity all the more challenging.

Managing Movement

Sourcing the right aircraft to ferry in excess of one million air passengers is one thing; handling logistics is another. The annual number of pilgrims is rising, especially from South and Southeast Asia, and so the Saudi Arabian government sets quotas for countries based on their Muslim population. Even with these quotas in place, the sheer volume of people causes travel friction.

The Mecca Route Initiative aims to make movement smoother. Five Muslim-majority countries (Bangladesh, Indonesia, Pakistan, Malaysia and Tunisia) now benefit from the service, which offers immigration pre-clearance for pilgrims at their points of embarkation.

The Size of the Market

The Saudi tourism sector is colossal. The Hajj and Umrah (a lesser, year-round pilgrimage) are responsible for an estimated $12 billion of GDP. By 2022, revenue from Hajj and Umrah travel is expected to be $150 billion – and Saudi Arabia’s Vision 2030 programme seeks to shift reliance from an oil-based economy to one more deeply rooted in tourism.

The market is huge, and it’s only set to grow. We’re certain to see growth continue, and aircraft procurement and ACMI will play an increasingly important role in the Hajj as it grows.

Maintain Availability During Hajj and European Peaks

With ACMI, availability can be maintained year-round, at known peaks and when unexpected opportunities arise. Short-term aircraft wet leasing from ACC provides aircraft and flight crew, and can include branding and optimised seating configurations.

We help airlines at capacity maintain availability throughout the year – even when the Hajj falls during their busiest periods – and with long-term leasing, we’ll be able to help airlines with their availability forecasting over the next decade of Hajj journeys.

To find out more, get in touch with our ACMI leasing team.